Bank of Canada Rate Increase - July 13th 2022

Bank of Canada Rate Increase - July 13th 2022

Date Posted: July 13, 2022

.png)

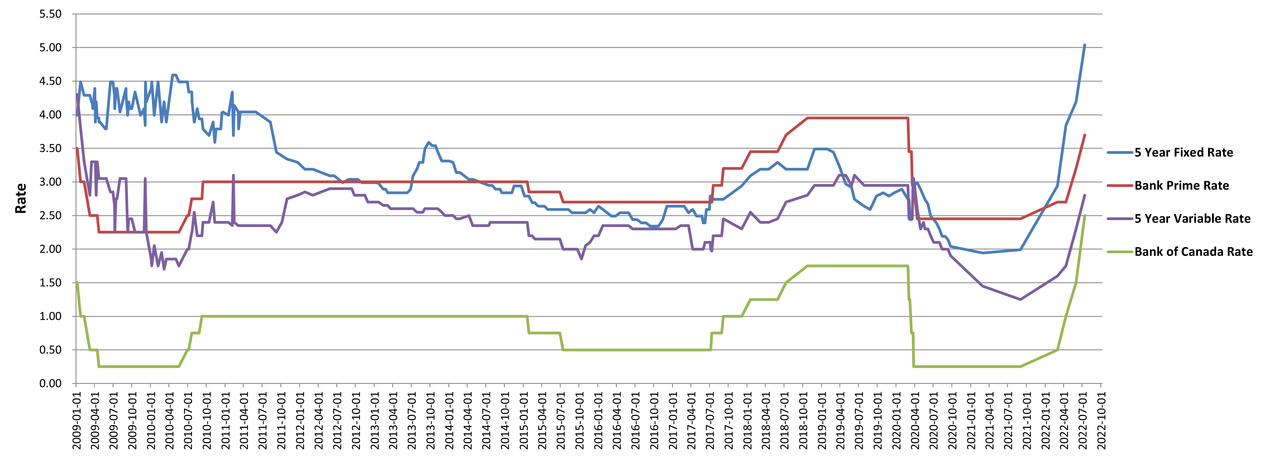

The BoC (Bank of Canada) has proceeded with an increase to the overnight rate of 1.00% to bring the new overnight rate to 2.50%. This is .75% above the pre-pandemic rate level we saw in 2020, where many economists felt we were headed prior to COVID.

The BoC dropped their overnight rates to historic lows in 2020, brought on by the pandemic in a bid to keep the economy stable; this was not meant to be a lasting measure. As businesses start to regain sales growth and in consideration of the current inflationary levels, the BoC wants to bring rates into a range more consistent with the current economic reality.

The chart below highlights the correlation between the BoC rate, bank prime rate, and the fixed and variable mortgage rates.

What does that mean for borrowers?

In the period following a BoC rate change, most lenders will also increase their prime lending rate. While the discount to prime for mortgage holders will remain the same, this could mean an increase in payments.

We broke down what a 1% increase to a variable rate mortgage at prime with a discount of 0.5% using a 25 year amortization. This would be an increase of just over $53 per $100,000 of mortgage. Any greater discount to prime would lower that amount.

If you have questions about your mortgage or financing, talk to your trusted Mortgage Agent today.

Read the full announcement here.